Chris Martin

Urban Air Mobility (UAM) is a freight train coming which doesn’t appear to have any brakes. Hopelessly underdeveloped from a community benefit and infrastructure point of view, the case for UAM is readily cited that UAM will change the way Australians and the globe travel but at what cost and how can we invest?

As major helicopter manufacturers look to the electric future, the development of Electric Vertical Take Off & Landing (EVTOL) machines continue to progress albeit with stagnation due to Covid-19 impact on revenue and margin decay across all major players.

Arms race if you will, I have spent plenty of time researching the intricacies of each EVTOL design platform published on beautifully crafted PowerPoints and videos with relative excitement. We are still a long way from having certified EVTOL aircraft (no aircraft can fly passengers until regulatory approval), as you can tell via the rendered infographics or stagnant prototype monocoques used for advertising however the future is coming. While I can confidently tell you which one looks the nicest I, like most observers, have no idea what specifications any of these futuristic machines posses. Determining what EVTOL will be utilised as the major adopter would be as difficult as predicting a horse race (alas some people believe they can predict this too). We can be certain that passengers will want to be able to ride in aircraft that have an extremely reputable brand behind the overall design with a proven safety track record. It will be about trust for both operator and aircraft, factors that have not changed for the aviation industry. Ultimately, cost will be the fundamental driver of the UAM revolution however the design of EVTOLs will significantly reduce these in comparison to the JetA1 / AVGAS consuming cousins. Helicopters by nature are incredibly maintenance heavy, Turboshaft engines are fickle beasts with transmissions in helicopters even more complex. EVTOLs will rid these issues. Engineers will still play a large role in the upkeep of electronic system dense platforms however maintenance cycles of EVTOL’s will greatly reduce operating costs, similar to what we have seen in the Electric Vehicle industry. People always joke about buying helicopters, it is one thing to have the purchase price covered however operating costs (including maintenance) will easily outweigh any price tag by a healthy multiple.

Aviation is a regulation game. Safety is paramount, anyone who tells you otherwise is either delusional or ill-equipped. The current state of the Australian Helicopter industry works on virtually non-existent margins hence anyone who is making excessively more money than others is clearly cutting corners, this in turn rotates back to and is shown in safety performance. Just look at SOAR aviation. UAM will see a massive influx of capital however no one will be able to fly if CASA (Australia’s regulatory body) and Air Services Australia do not sort out aviation noise related issues. Currently there is very little a member of public can do if they do not like the noise coming from the sky. Anyone who has been through this process will attest to the fact that the noise complaint line is woefully under resourced but for good reason. There is a vested interest for Air Services to see aviation traffic increase as they generate revenue fees from traffic services hence it would be illogical for them to come down hard on any operator based on a few pesky noise complaints. This leaves a gaping hole in EVTOLs future social licence. If the community do not feel like they have a say in the direction of the very noise that irritates them each day in the sky then we will very quickly have no EVTOLs. Anyone can relate to this who has been at the beach and had a small drone circle above them. This will leave the opportunity for community groups to campaign for change with local councils being forced to get involved to represent and protect the amenity that their rates payers have paid for when buying their dream home. Air services Australia’s conflicted interest will be under extreme focus in the future and will have to fight hard to protect their mandate of managing noise complaints from a range of outside regulatory/ community bodies.

Infrastructure plays a critical role in Urban Air Mobility however it is woefully under resourced and not thought through. For one if you would like to land a helicopter on private land there is nothing legally to stop you as long as you have written land owners permission and the pilot deems it safe. Problems arise if councils elect to ban helicopters (another great example of where Air services have let down all stakeholders to the point where councils need to step in) however there are currently very few restrictions. With UAM and the rapid rise of the number of EVTOLs due to the rapidly decreasing operating costs are we as a society happy for anyone to land anywhere as long as the landowner permits? The answer is personal but a level-headed person would say the sample mean would be probably not. This means that we need to build more heliports in locations that is suitable to the community. Land prices are rapidly increasing every day and urban sprawl is largely eating land deposits around all major capital cities at a rapid rate. Lawmakers will need to consider where to permit such a piece of critical infrastructure given that passengers will not want to fly out of our current airports as most are some distance in terrible traffic from the central business district. Companies who intend to operate EVTOLs to service the rapidly expanded total addressable market of UAM compared to regular helicopter operations will also need to consider their position as it will greatly affect them and their social licence to operate.

EVTOLs are the only option if we are to achieve Urban Air Mobility. There will be plenty of hurdles but ultimately convenience and price will be a stronger driving factor for the industry over anything else.

So where does this leave us to allocate our capital into a business to see a healthy long-term return? For arguments sake, we will stay in the listed markets because as it is fundamentally easier to analyse the opportunity as a retail investor.

As mentioned earlier trying to determine which aircraft manufacturer will become the Blackhawk (Completely dominated military helicopter sales across broad range of allied countries) or AW139 (Completely dominated the medium twin-engine helicopter space, so much so that Airbus publically declared defeat adopting terms like “AW139 Killer” for their new helicopters) of EVTOL will be very difficult. I have tried to take a step back and look at across the board what will these EVTOLs require. Weight capacity is one of the overarching themes. Electric battery technology is incredibly heavy however anything that flies requires an exceptional power to weight ratio performance. Useful payload and speed is the two most important factors. This is where advanced composites come into play.

Hexcel (NYSE : HXL)

No doubt about it Hexcel’s main revenue drivers (55% of 2020 sales revenue, $822.3 million) are providing composite fibres, mainly carbon fibre fabric and parts to commercial aerospace namely Airbus (33% of total net sales) & Boeing (19% of total net sales) respectively and together making 84% of commercial aerospace sales. Looking at those numbers alone is alarming, one only has to look at what Coles and Woolworths are doing to suppliers currently to be concerned about dealing with only two companies as a large proportion of sales. However, as a leader in carbon fibre for aerospace Hexcel boasts a great array of cutting edge companies as customers across a relatively diverse range that reduce the risk significantly. Companies who want advanced materials approach Hexcel for solutions.

It has taken a walloping due to Covid-19 as manufacturers of airplanes slash production rates and destock (use the inventory they had already purchased to reduce outlying costs on balance sheet and provide a bit of a sugar hit to your financial performance) but its core business remains resolute. Gross margins reduced from 27.2% in 2019 to 16% in 2020 highlighting the squeeze from Covid-19 on the business. Operating margins were 0.9% in FY2020 however Hexcel has a proven track record to run at circa 17% in normal operating conditions which is pretty impressive for a large manufacturing business.

The percentage of composite material in aircraft are on the significant rise with each iteration and this will be no different for UAM / EVTOL. EVTOL will be a major growth driver for Hexcel in the future. Aerospace grade carbon fibre is difficult to produce at cost effective rates. Hexcel has invested heavily in reducing costs to themselves and manufacturers including minimising the requirements of autoclave systems as opposed to regular ovens and reducing prepreg resin infusion saving weight and curing time. Carbon Fibre material only makes economic sense in cases where extreme strength is required and weight is a massive disadvantage, a good example of this is cars, aluminium works great on conventional vehicles where price is a greater disadvantage to weight but you do not see aluminium on an F1, it is almost completely advanced composites.

Lockhead Martin Raider X with Hexcel Composite

Where people continue to search the world over for a Covid-19 rebound that will be sustained long after Covid is a topic of conversation I believe Hexcel offers that opportunity with margins and sales volumes only to improve as Urban Air Mobility progresses and aviation travel booms requiring an uptick in production volumes of first narrow body aircraft but then wide body aircraft.

Envirosuite (ASX:EVS)

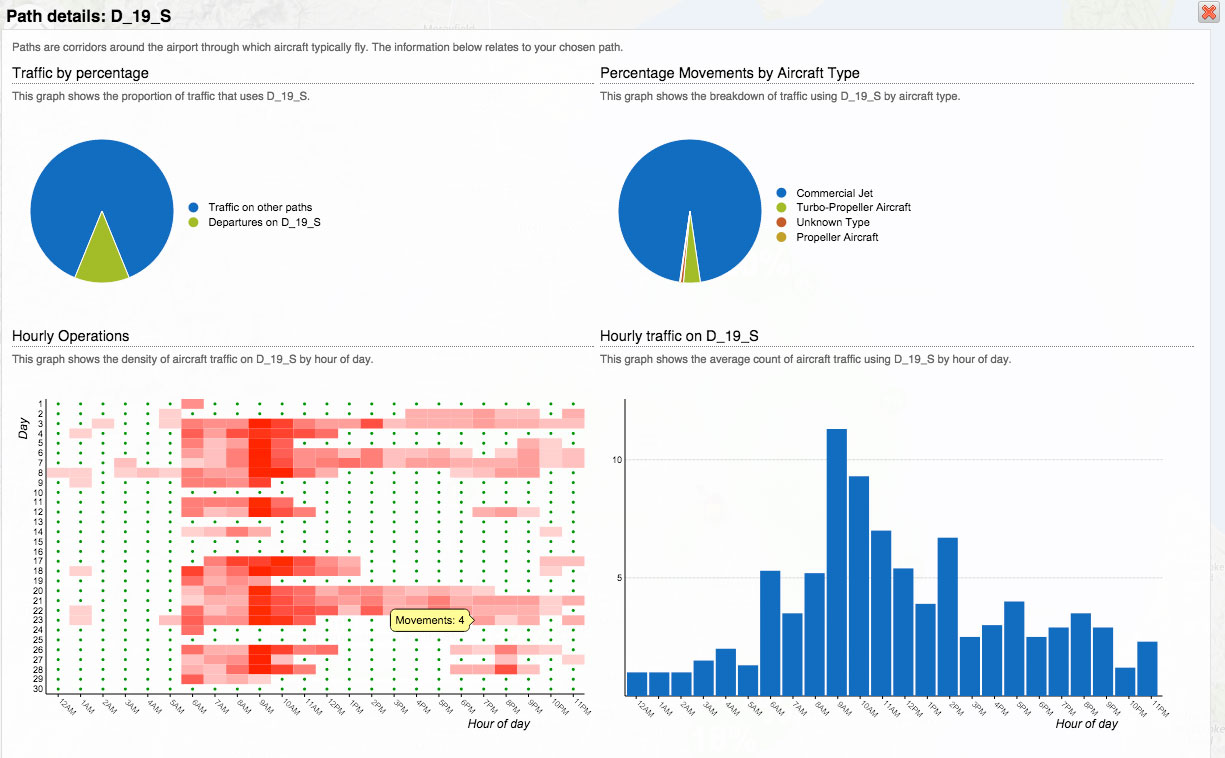

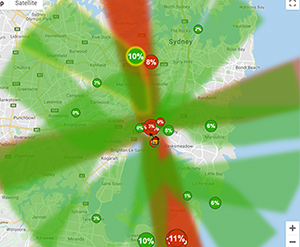

Envirosuite is a small Australian based Environmental Intelligence company. While Environmental Intelligence seems to pander to two perfect buzz words in the world of ESG investing, currently EVS can actually support the title with nifty software products that are already highly regarded. As we are discussing Urban Air Mobility I will specifically focus on their airport noise and monitoring systems. EVS reported $32.1 M in revenue based on 163 sites utilising the software. The software allows airport managers to predict real time noise effects and greenhouse emissions based on aircraft movements taking into account for terrain and weather effects. As discussed above Airservices manages noise complaints in Australia pretty poorly however the software they use is very impressive, all powered by Envirosuite. Don’t take my word for it though, you can access some of the tools here:

https://webtrak.emsbk.com/mel3

https://myneighbourhood.emsbk.com/syd5/

Envirosuite notably didn’t lose revenue due to Covid-19 in it’s aviation sector. A truly remarkable result considering what Covid-19 has done to airport balance sheets which only further strengthens the business case for its aviation software products. EVS will do well out of UAM, people will want to know exactly the level of noise disruption EVTOLs are having and with EVS Webtrak the public will be able to see that in real time. Even without UAM, airport noise complaints will explode once Covid-19 travel shutdowns are over given that people may still be working from home and not used to/ forgotten the roar of a multiple turbofans in close proximity sounds like. Councils stepping up on the back of lobbying from rate payers as mentioned earlier will ensure new clients onboard that are not traditional airports. EVS Gross margins have steadily improved over FY21 to 42.4%. It is Envirosuites other products that have been the cause of questionable performances however the company appears to have turned a corner signing recent contracts albeit small in dollar terms but promising for product adoption.

Envirosuite is an interesting company providing software that really does service the industries that deal with complaints the most. If you have empirical evidence of such events while predicting these complaints in real time it would be highly beneficial for conflict minimisation and protect your social licence to operate.

If you got this far thanks for reading.

This isn’t financial advice in anyway shape or form, I just enjoy researching companies.

Always learning, send me your thoughts / feedback to chrismrtn611@gmail.com